When asked what accountants do, responses often mention roles such as tax agents and independent auditors. The functions performed by the vast number of professional accountants who work in businesses are often forgotten and not well understood.

Professional accountants in business often find themselves being at the frontline of safeguarding the integrity of financial reporting. Management is responsible for the financial information produced by the company. As such, professional accountants in businesses, therefore, defend the quality of financial reporting right at the source where the numbers and figures are produced!

Accountancy professionals in business assist with corporate strategy, provide advice, help businesses reduce costs, improve their top line, and mitigate risks. On the hunt of top accountants in Bayside, Melbourne? Finding the right accountant can be a stressful endeavour. After all, there are so many stores, options, and prices out there to consider. So, finding an accountant that offers supreme service and a carefully curated selection of services is a true life-saver.

To help you get started looking for an accountant, we’ve rounded up the best accountants from right across Bayside, Melbourne.

Read on to discover where to start your search.

Ultimate List of Accountants in Bayside, Melbourne

Hillyer Riches Accountants Melbourne

(03) 9571 5333

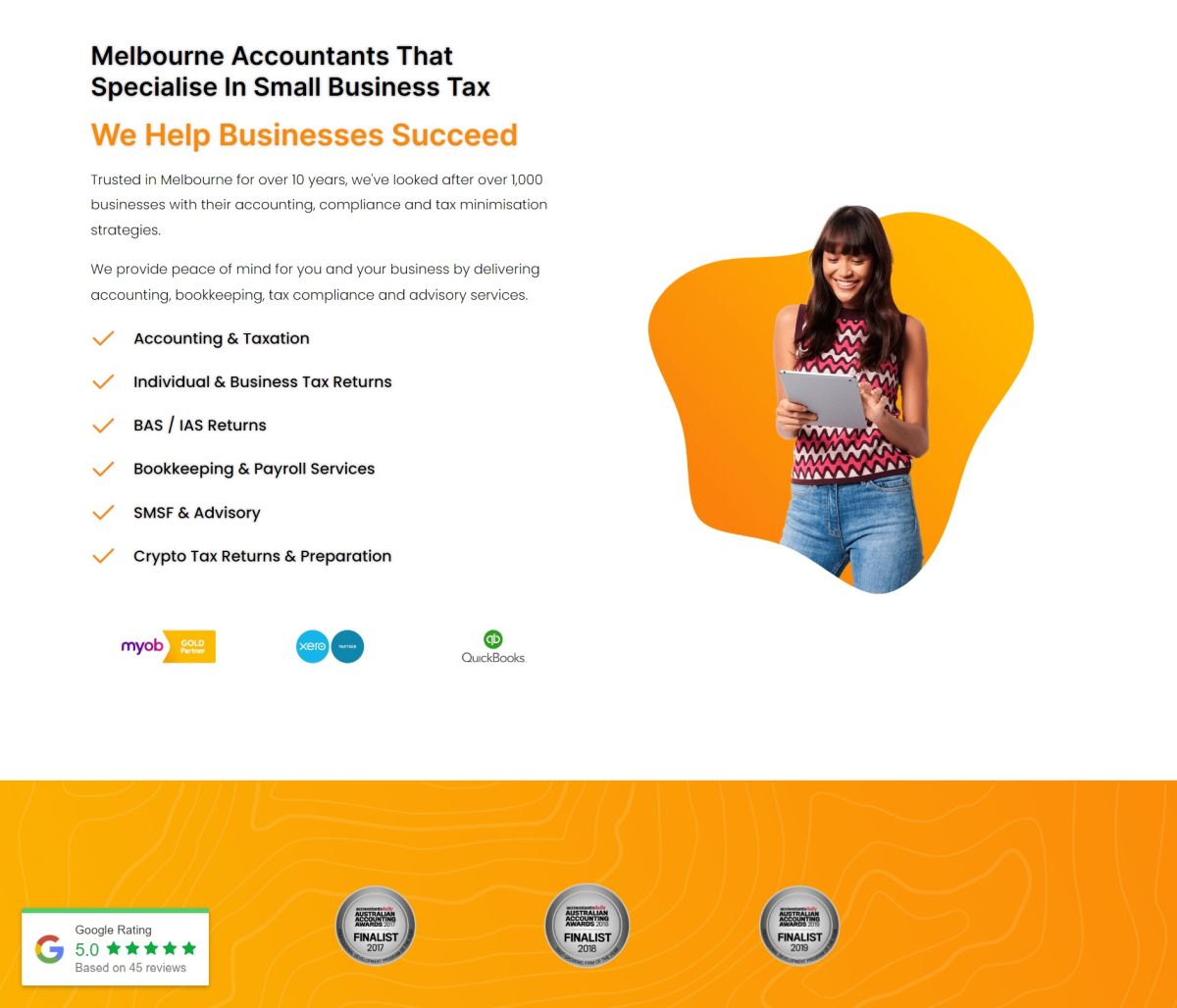

Hillyer Riches, based in Carnegie, Victoria, has been a trusted name in accounting software and business advisory services since 1987. With over 30 years of experience, they have assisted over 1,000 businesses with their accounting, compliance, and tax minimization strategies. The firm is dedicated to providing peace of mind to both businesses and individuals by offering a comprehensive range of services. Their approach emphasizes cloud accounting and bookkeeping automation solutions, ensuring clients receive practical advice that yields tangible results.

Services Offered:

- Accounting: Efficient and accurate accountancy services with a focus on cloud-based solutions.

- Bookkeeping: Comprehensive bookkeeping services, including software setups, BAS lodgements, and payroll services.

- Taxation: Proactive tax services ensuring compliance and tax minimization.

- Business Advisory: Strategic advice for business growth, risk management, and compliance.

- SMSF (Self Managed Super Fund): Guidance on retirement planning and SMSF management.

- Financial Advisory: Personal and business wealth growth strategies and financial management.

Contact Details:

- Address: Suite 8, 1044A Dandenong Road, Carnegie Vic 3163

- Phone: (03) 9571 5333

- Email: info@hillyerriches.com.au

- Hillyer Riches Official Website

EWM Accountants & Business Advisors Melbourne

ewmaccountants.com.au | oakleighaccountants.com.au

03 9568 5444

EWM Accountants and Business Advisors, located in Oakleigh, Victoria, provide a comprehensive suite of accounting and advisory services tailored to meet the diverse needs of their clients. As a specialist taxation and advisory firm, EWM Accountants emphasize a client-centric approach, offering tailored solutions that fit the specific requirements of each client. Whether it's through modern cloud accounting or traditional correspondence, their commitment is to deliver efficient and accurate services, ensuring clients' financial matters are handled with utmost precision and care.

Services Offered:

- Accounting: Cloud-based and traditional accounting solutions.

- Taxation: Comprehensive tax services ensuring compliance and optimization.

- Bookkeeping: Including software setups, BAS lodgements, and payroll services.

- SMSF Accounting, Taxation, and Audit: Expertise in Self Managed Super Fund management and auditing.

- ATO Audit Assistance: Guidance and support during ATO audits.

- Business Finance and Insurance: Financial advice and insurance solutions tailored for businesses.

- Business Review & Planning: Strategic business advisory for growth and risk management.

Contact Details:

- Address: 63 Westminster Street, Oakleigh, VIC - 3166

- Postal Address: PO Box 259, Oakleigh, VIC - 3166

- Phone: 03 9568 5444

- Fax: 03 9568 5955

Bookkept Business Accountants Melbourne

(03) 8568 3606

Bookkept, a CPA qualified accounting and business advisory firm based in Melbourne, offers specialized services to small and medium-sized businesses across Australia. With a focus on modern solutions, they handle compliance, bookkeeping, ATO matters, and are experts in platforms like Xero/MYOB and payroll systems.

Beyond traditional accounting, they provide insights into business processes and systems, ensuring businesses have the tools to grow their revenue. Founders Daniel and Brendan envisioned a progressive accounting firm, breaking away from conventional practices.

They emphasize transparency in their fees, prioritizing service delivery over time spent. Their innovative approach, combined with over 15 years of combined experience, ensures clients receive tailored advice, helping them understand their financial reports and future-proofing their operations. The team's dedication is evident in their commitment to client success, utilizing cloud-based solutions for a holistic view of business performance.

Tax Window

Situated in Melbourne, Tax Window is a well-regarded accounting firm dedicated to helping individuals and businesses reach their financial objectives. Using a strategic approach, the company transforms clients' aspirations into realistic goals. With a substantial 30-year history, Tax Window distinguishes itself by assigning senior accountants, rather than junior ones, to oversee client matters. The firm emphasizes its transparent pricing model, highlighting that, despite their expertise in accounting, their charges differ from the traditional accounting norms.

Services Offered:

- Investment Planning

- Small Business Accounting

- Tax Agent Services

- Advice on SMSF (Self Managed Super Fund)

- Business Advisory

- Specialized services for various industries including bars, franchises, tradies, builders, cafes, medical practitioners, startups, plumbers, and restaurants.

- Property Consultation

Contact Details:

Website: https://www.taxwindow.com.au/

Address: Level 1/441 South Rd, Bentleigh VIC 3204

Operating Hours: Mon-Sun 9:00-18:00 (By Appointment)

Phone: 03 9999 8538

Email: info@taxwindow.com.au

Bayside Business Accountants Melbourne

(03) 9583 4319

Bayside Business Accountants offers comprehensive "Peace of Mind" tax services for individuals and empowers small business owners with insights to run their ventures efficiently. Distinguished from other accounting firms, they boast a team of dedicated professionals adept at navigating Australia's intricate tax landscape. Their core mission revolves around ensuring optimal outcomes for clients, fostering a stimulating environment for their staff, and contributing to the community through sponsorships and pro-bono initiatives.

Their services are proactive and innovative, catering to a range of clients. For individuals, they offer advice on asset protection, estate planning, and employee income nuances. Businesses can benefit from their expertise in asset protection, ensuring both the enterprise and personal assets are safeguarded. They also cater to the growing segment of property investors, providing insights into the booming property rental market. Additionally, as accredited SMSF specialists, they offer compliance advice and can assist in establishing new funds.

RBizz Accountants Melbourne

1300 072 490

Billed as a comprehensive hub for business accounting, tax, and advisory services, this firm boasts a diverse team of Chartered Accountants, Business Advisors, Tax Agents, Virtual CFOs, Bookkeepers, and more, all equipped to provide a holistic business solution. With over 25 years of experience in global businesses and Big 4 firms, they offer a range of services from taxation, accounting, business advisory, to recruitment and systems implementation.

Their mission is to deliver tailored professional services to small businesses, sole traders, and individuals, emphasizing ease, reliability, and results at competitive prices. Their approach prioritizes the 'how' over the 'what', fostering a culture of speed, creativity, and continuous improvement. The team's unique strength lies in their combined experiences in global businesses, top-tier accounting firms, and advanced business systems and technologies. With qualifications spanning CA (AU), CPA (AU), CPA (US), and CA (IN), they ensure top-tier expertise in all professional services they offer.

Rubiix Accountants Melbourne

rubiixbusinessaccountants.com.au

(03) 9603 0067

Rubiix Business Accountants stands out as more than just a conventional accounting firm. Prioritizing genuine partnerships, Rubiix offers expert advice and services in taxation and business accounting. With a diverse clientele spanning Australia, New Zealand, and beyond, they specialize in catering to small to medium family-owned businesses, superannuation funds, various entity structures, and high net worth individuals. Their emphasis on fostering strong client relationships ensures tailored financial solutions that align with clients' goals, ensuring they achieve the balance they desire in their financial endeavors.

The success of Rubiix is deeply rooted in its workplace environment, where staff satisfaction is paramount. The team thrives on collaboration, encouragement, and shared responsibility, ensuring they consistently deliver optimal outcomes for their clients. This cohesive work culture translates to unparalleled customer service, with a keen focus on understanding and developing client businesses. Through business mentoring and exceeding client expectations, Rubiix remains committed to guiding clients towards their vision and business success.

OZ Smart Tax Solution Melbourne

0433 751188

WE ARE RELIABLE

Are you looking for an accountant? We are here to help you!

Smart Tax Solution was established in 2007 based in Southeast Melbourne.

We have developed tailored accounting and tax solution to suit industries ranging from self-employed businesses to corporations, focusing on providing top accounting services in this professional industry.

At Smart Tax Solution, we work hard to help the client reach financial freedom.

OUR SERVICES

Business Consulting

We provide small to medium business consulting such as structure formation.

Taxation Service

We provide a comprehensive range of taxation service from an individual, company, partnership, trust, and self-managed super fund.

Corporate Service

As an ASIC register agent, we do provide corporate secretarial service.

Finance

We provide home loan service include new application and refinance, and we also provide asset finance through our business partners.

Bookkeeping Service

We provide a bookkeeping service to help your business grow without stress.

Insurance Service

Let us talk about what is the value of insurance and hidden terms and condition. Our business partners will help you through the target.

OUR FIRM CULTURE

Smart

We try to work out a smart solution for our client

Reliable

We do believe reliable is one of the major keywords to serve the client.

Fast

We do provide guarantee fast service in our firm.

knowledgeable

We do understand knowledge is the most important element in the business consulting world.

Bruce Edmunds & Associates

(03) 9589 5483

Established in 1966, Bruce Edmunds has a proud history of service to clients. We are business accountants in Melbourne offering specialist taxation advice and financial planning to businesses and individuals.

Business accounting, in particular, is future-focused. It focuses on building an accurate picture of your business’s current position, performance and financial wellbeing.

With the information provided by your business accountant, you are armed with the right materials to perform long-term planning, strategies and evaluate progress towards your business goals.

With a business accountant on your side, your business won’t only have the numbers and data to make decisions – our team are experienced in helping business owners plan for the future.

We’ll use our expertise to advise you on what direction your business should take and create an actionable plan to get you there.

MAS Tax Accountants Melbourne

402 523 669

Need an accountant? Are you ready to get your personal finances in order?

From individual tax needs, home loans to business accounting solutions, our priority is helping you clear financial hurdles.

If you’re looking for a tax accountant in Cheltenham, we offer a wide variety of services to meet your personal and business accounting needs. We understand the importance of reliable, accurate tax and accounting and how it can affect your personal and business responsibilities. To ensure that you receive the finest services and advice, our experienced Accountants take the time to understand your or your business’s specific needs. By knowing your current situation, we can tailor our services and provide solutions to set you in the right direction.

Put your business in good hands. Find out how we can help you save time and money by reaching out today.

Businesses have to meet specific regulations to avoid penalties and maximise growth. Businesses can get all of their business accounting needs to be met here. Tax time is easy with our expertise in sole trader returns and business tax returns. Other services include Self-Managed Super Fund setup, business forecasting and budgeting, and business lending assistance.

Rest easy, knowing that your business financial needs are being met. Call today to set up an appointment and get more information.

As you grow your small business, it’s essential to meet financial reporting regulations and tax standards to avoid financial penalties. Our tax services ensure that your taxes and business accounting statements are submitted on time, so you’re prepared for tax time. Tax compliance can be complex and overwhelming for those who aren’t familiar with compliance regulations.

Our experience in small business accounting helps you remain compliant with financial reporting regulations, payroll regulations, and more. When it’s time to expand your business, We are here to help you compare lending options and find the right funding source for you.

WHO ARE WE

Based in Cheltenham and providing expert services to the local area and surrounds, our qualified Tax Accountants can assist you in preparing and lodging all your tax, compliance and accounting duties. Working with individuals and different-sized businesses, we can help you to effectively manage your responsibilities and remain organised throughout the year.

At MAS Tax Accountants Cheltenham, providing high quality and useful solutions is our number one priority.

We understand the importance of reliable, accurate tax and accounting and how it can affect your personal and business responsibilities. To ensure that you receive the best services and advice, we take the time to go over your financial situation and understand your specific needs. This helps us to tailor our services and provide solutions that will keep you on track.

MAS Tax Accountants Cheltenham Principal, Jojo Jose, is a CPA and Chartered Global Management Accountant. He is a qualified Accountant with more than 15 years of commercial accounting experience across a range of industries, including manufacturing, exports/imports and pharmaceuticals.

Jojo’s primary focus is to be a trusted source of information and assistance and direct you towards financial success and excellence. In addition to his individual and business tax accounting abilities, Jojo can help you with your business’ strategic planning, commercial finance, forecasting, profitability improvement, and diagnostics.

Feel confident knowing that all your Tax, Compliance and Accounting commitments are being properly managed with expertise and care. Contact us today to discuss your options.

Enquire about our flexible appointment options, such as after-hour and weekend times and meeting you at your home or office.

HTS Accountants Melbourne

03 9555 5321

HTS Accountants is proud of its personal approach to clients. Working as an effective, tight-knit practice offering uncompromising personal service, our practice has carved itself a distinctive market niche.

We are committed to building and maintaining a close working relationship with clients. We recognise that each tax or other financial issue is different and requires timely and practical advice which best meets the client’s individual needs.

Business Hours: 9 am - 5 pm

Other times for consultation are available upon request.

HTS Accountants began in 1978, and over the years, has developed a personal and efficient client service, competent in all facets of Taxation and Accounting, with friendly, caring and capable staff.

RBK Advisory Accountants Melbourne

1800 725 726

We are a team of out-of-the-box thinkers who have stripped back an over-priced, over-complicated industry and have created an efficient business, where conversation and getting to know people and their financial needs is a priority.

Our services

Services that cover the full spectrum of business and personal accounting, financial and advisory needs.

Accounting & Tax

We are accountants who specialise in playing an active role in your growth and happiness.

Financial Planning

We’re here to ensure your hard work turns into a great bank balance and a solid future plan.

Mortgage Broking

We are making the loan process as stress-free and smooth as possible.

Bookkeeping

As a business grows, you may think about outsourcing your bookkeeping to free up time.

Phalanx Accounting Bayside Melbourne

(03) 9530 8274

Why Is Phalanx Accounting Unique?

Our focus is on learning and understanding our clients business and personal objectives.

We are committed to a long and fruitful relationship. As ‘Your Business Confidant’, we provide a high-quality service by achieving a deep understanding of your business and personal objectives. We provide support for managing your business and personal assets.

Our Services

- Accounting & Taxation

- Financial Planning & SMSF

- Strategic Finance

- Strategic Property Advice

- Business Consulting

KK Partners Group Accountants Bayside Melbourne

(03)8534 5500

At KK Partners Group, we understand the needs of people in business and are committed to providing timely, accurate and professional service. Our aim is to achieve the best outcomes for business accounting, taxation and management requirements.

We strive to develop partnerships with our clients that allow us to gain a better understanding of their evolving needs and changing expectations.

SERVICES

Accounting

We understand that reliable, timely and accurate accounting is essential to the success of every business.

Business & Management

Our team strives to develop strong partnerships with you, enabling us to provide pro-active suggestions and solutions.

Taxation

We offer a wealth of practical experience and specialist tax knowledge to help you meet all your tax and regulatory requirements.

KK Partners Group is a progressive firm of Chartered Accountants conveniently located 20 minutes from the CBD.

Originally established in 1979 as Kayman Chartered Accountants, the firm has progressed throughout the years to become the largest accounting firm in Brighton.

Throughout our history, we have assisted individuals, businesses and self-funded retirees, with a particular focus on the small to medium business market. Remaining true to our core client base has enabled us to develop a depth of knowledge and expertise specific to our clients’ needs.

The IF Group Accountants Bayside Melbourne

theifgroup.com.au/peter-crabb-and-associates

1300 655 099

Peter Crabb and Associates - Financial Planning & Accounting Services Melbourne

The IF Group is pleased to announce the acquisition of Peter Crabb and Associates, and we welcome these clients to our suite of accounting and financial expertise.

Peter Crabb and Associates’ accounting professionalism is an important part of The IF Group’s strategy of providing the highest levels of client fulfilment across the range of complex financial matters facing individuals, families and businesses today. Take a look at what you can expect from our expert accounting team.

We celebrate this expansion of service and solutions. We are expanding our services to better meet the needs of our clients and technology. Our offerings range from financial, tax and business strategies to help clients manage their financial affairs, cash flow planning, reviews of existing and/or new investment ownership, loan structures, superannuation planning, tax planning, wealth protection for family benefits and more.

MG Financial Services Pty Ltd Accountants Melbourne

03 9523 6509

Our focus is on making sure you’re in the best possible financial position.

How Do We Do This?

We apply the knowledge that extends for over 25 years to your business and personal situation.

With a multitude of experience in providing specialised advice to small to medium businesses, MG Partners will better position your business to achieve optimum financial results.

ACCOUNTING & TAX

Stay on top of your business with current and accurate financial data.

Put your financial information in the trusted hands of professionals who can take care of all your accounting needs.

AccountingTax

We specialise in:

- Tax planning advice

- Financial Statement preparation for sole traders, partnerships, trusts, companies, and superannuation funds

- Preparation of taxation returns for individuals, partnerships, trusts, companies, and superannuation funds

- Establishment service to create trusts, companies, and self-managed super fund

Ensuring all your compliance obligations are up to date for the:

- Australian Securities and Investments Commission

- Australian Taxation Office

- Advising on and setting up your record-keeping system

MG Partners is committed to providing you with ongoing reporting and providing active commentary on your financial situation.

MR Hibbert Financial Services Accountants Melbourne

(03) 9787 5109

Michael Hibbert established our firm in 1976 as an accounting practice, specialising in taxation advice, tax returns and general accounting services. Since then, the firm has expanded substantially, and our team now boasts expertise in such revenue areas as International Tax and Double Tax Treaties, Primary Production, Thoroughbred Bloodstock, Research & Development, Foreign Investment Review Board advice, Government benefits eligibility, and SMSF and SMSF borrowing, such as Limited Recourse Borrowing arrangements.

Services

Businesses

Our team has extensive experience in all aspects of business accounting and taxation.

Whether you’re a small single director company or have a complex structure with many involved parties, we can help. We believe a sound business relationship with your accountant is vital to your business success, that’s why we pride ourselves on offering our clients the same great service year after year and watching our client’s grow and prosper.

Our team is here all year round and happy to answer the smallest of queries you may have with your business accounting needs. In growing your business with us, you may require changes to your current structure or the way in which you operate, and we are able to advise and assist you in this process and guide you through these changes.

We have a dedicated team member who administers the corporate section. She has a comprehensive knowledge of all ASIC related issues, the establishment of trusts and companies and will guide you through the steps to ensure your entity is correctly set up and has met its compliance needs.

Let us relieve you of the burden and allow us to prepare your quarterly or annual BAS summaries, PAYGW, and Subcontractor Returns. All can be completed and lodged online so you can focus on running your business and not getting bogged down with paperwork.

- Sole Trader business accounts

- Partnership accounts

- Trust/Company Accounts

- Structuring of your business and new entity setups

- Annual Taxation returns and financial reporting

- Corporate management and compliance

- Small Business Concessions

- Capital gains

- Investments

P Sulman & Associates Accountants Melbourne

(03) 9528 4074

We pride ourselves on great service to you – tax compliance, accountancy & ultimate business success.

CHARTERED ACCOUNTANTS, BUSINESS ADVISORS & TAX AGENTS

P Sulman & Associates are a dedicated, friendly team. You’ll receive prompt, professional accounting services plus personalised attention.

We are a proactive accounting, tax and business advisory firm that listens to your needs. You receive quality advice, plus cost-effective strategies and solutions.

HOW WE WORK WITH YOU

Clients tell us they do business with the people that they trust. Being a trusted advisor to businesses takes more than an accounting degree. The team at P. Sulman & Associates offer a variety of services (friendly and personable) working with you for your best interests.

GET MORE FROM YOUR ACCOUNTANT

Phil has over 30 years’ experience in public practice. He is a member of the Institute of Chartered Accountants, the National Tax & Accountants Association, and is a Registered Tax Agent.

STARTING UP? START OUT HERE

When starting a business, how do you know you are making the right choices to protect yourself, your family and your assets?

4 STEPS TO SUCCESS – START HERE

We help you with: Choosing the right business structure. Essential Tax and Business Registrations. Prepare a business plan. Budgets and cash flows…

The team at P. Sulman & Associates offer a variety of services, including:

- PROFIT IMPROVEMENT PROGRAMS

- TAX MINIMISATION

- MANAGEMENT CONSULTING

- STRATEGIC FINANCIAL PLANNING & BUDGETING

- ANNUAL COMPLIANCE AND YEAR-END TAX PLANNING

- TAX, BAS, BOOKKEEPING AND PAYROLL SERVICES

- SME / HOME BUSINESS / SOLE TRADER PLANNING & ADVICE

- ESTATE STRUCTURE SO YOU CAN PROTECT YOUR ASSETS AND YOUR FAMILY

Business owners turn to P. Sulman & Associates for a range of easy to understand services, including accounting, taxation and business advice.

OUR PHILOSOPHY

Service means different things to different people.

To us, it means everything.

- Pro-active and innovative accounting and advice.

- More than accounting services. You benefit from a “business coach” level of service. We work with you, provide advice to grow your business.

- An approachable, easy to understand the team of professionals.

- A thorough understanding of your individual needs. You receive technically sound and success driven advice.

- A commitment to delivering. No business or job is too small.

- Ongoing training and extensive development. We provide advice to you regarding the constantly changing tax and superannuation laws.

- Easy to contact. Your calls are returned promptly.

WHO WE SERVICE?

Clients span a range of industries. However, we’re seen as specialists with building and related trades. We’re also recognised as specialists in business start-ups, negatively geared investment properties and self-managed superannuation funds.

PRUDENT & TRUSTWORTHY ADVICE

As a progressive accounting firm, we continually adopt the latest technology systems to service our Australia wide customer base. Regular communication with our clients is a priority. Our quarterly ‘On the Money’ newsletter includes business development strategies plus wealth creation tips. We will help you every step of the way – from structuring, tax planning, budgets, appropriate software choices to instructing solicitors, applying for a loan, company compliance requirements, starting or maintaining a self-managed superannuation fund or just preparing your tax return. Discover how we can help you.

Bryan Cole & Associates Accountants Melbourne

03 9585 4109

At Bryan Cole & Associates, we take the time to understand the needs of our clients, providing you with both a professional and personal service.

Using our specialist skills and comprehensive tax knowledge, we are not just accountants but your trusted business advisors. Specialising in providing advice to small and medium-sized businesses as well as individual clients and Self-Managed Superannuation Funds, we are committed to building relationships taking you from where you are today to where you’d like to be in the future.

Services

By getting to know each of our client’s personality, we can tailor our advice to your specific needs or to the needs of your business.

By providing a fully client-focused service, we can help you get the best results now whilst formulating plans for the future to put you in the best place for retirement.

TAXATION

We are here to help you maximise your income to work more effectively for you. We understand tax and have built a proud reputation for excellence in Taxation.

BUSINESS SERVICES

Our professional staff are well trained and have extensive experience in accounting and financial services. We work with our clients to help them achieve their goals.

SUPERANNUATION

Whether you are looking to accumulate assets, grow your existing portfolio or plan for retirement, we will spend time to understand your needs and desires to ensure your financial future is secured.